If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. Have you found yourself in the position of needing to prepare a balance sheet? Here’s what you need to know to understand how balance sheets work and what makes them a business fundamental, as well as steps you can take to create a basic balance sheet for your organization.

- To put it trivially, the further down you go in the list of uses, the quicker the money is available.

- Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report.

- Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio.

- Department heads can also use a balance sheet to understand the financial health of the company.

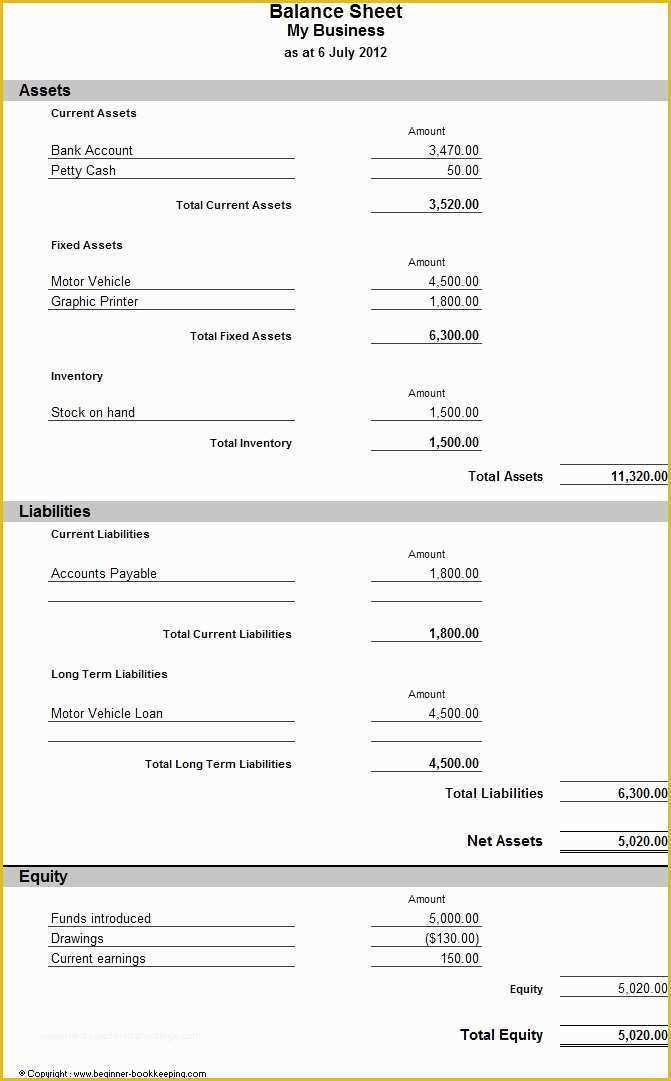

Shareholders Equity Section

Here are five steps you can follow to create a basic balance sheet for your organization. Balance sheets are usually prepared by company owners or company bookkeepers. Internal or external accountants can also prepare and review balance sheets. If a company is public, public accountants must look over balance sheets and perform external audits. Looking for an even simpler way to create balance sheets that support your business? FreshBooks’ free balance sheet template will help you keep track of all the information you need to manage your numbers with ease, helping you to check balances and keep your finances in order.

Great! The Financial Professional Will Get Back To You Soon.

Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. At a glance, we can see that ABC Company’s assets increased during this year from $1.975 billion to $2.395 billion.

What is included in the balance sheet?

If you need help understanding your balance sheet or need help putting together a balance sheet, consider hiring a bookkeeper. Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

Balance Sheet Template: Standard Format

Take a look at these examples to give you an idea of what to include. On a balance sheet, assets are usually described starting from the most liquid, through to those long-term assets which may be more difficult to realise. Let’s take a look at the type of assets which feature on a balance sheet. As the name suggests, the equation balances out, with assets on the one side being equal to the sum of liabilities and equity on the other. If the shareholder’s equity is positive, then the company has enough assets to pay off its liabilities. Even better, QuickBooks Online gets you access to QuickBooks Live Expert Assisted, which can include having experts send your balance sheet to you.

When completing your taxes or providing financial information to regulatory authorities. In some cases, businesses are required to submit their balance sheet and other financial statements for tax purposes. Determining your business’s ability to meet current financial obligations or defining your working capital.

These reports are also used to disclose the financial position and integrity of your business (i.e., the overall value of your company), which is vital for attracting investors. Lastly, these statements are legally required to be produced and filed by public companies. In this example, the imagined company had its total liabilities increase over the time period between the two balance sheets and consequently the total assets decreased. When creating a balance sheet, start with two sections to make sure everything is matching up correctly. On the other side, you’ll put the company’s liabilities and shareholder equity. The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholder’s equity.

The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. It’s important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP).

HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program. Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. As with assets, these should be both subtotaled and then totaled together.

It may not provide a full snapshot of the financial health of a company without data from other financial statements. It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet. Below the assets are the liabilities and stockholders’ equity, which include current liabilities, noncurrent liabilities, and shareholders’ equity.

A balance sheet captures the net worth of a business at any given time. It shows the balance between the company’s assets against the sum of its liabilities and shareholders’ equity — what it owns versus what it owes. The balance sheet (also known as the statement 5 ways to build and improve your business credit of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular date. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

Detalles Solidarios

Detalles Solidarios HAZTE VENDEDOR

HAZTE VENDEDOR